Have you ever felt like the town crier that no one listened too? I have, and in the case of SPY this last year I really did. In a trading group that I am a part of daily when SPY was at 370 I kept saying that it was going into a Cup with Handle formation. That is a very very very bullish and powerful chart pattern. During that time many of the talking heads were saying crash crash crash. Those like myself that are students to the movements of the market throughout it’s history said we are going to see a great bull run. And we have. This formation pattern is started with a straight angle up on the left side, a “Cup” then forms, a small pullback occurs we call that the “Handle” then it’s off to the races. This pattern has the highest historical win rate of any technical chart pattern but also happens the least. One caveat is it often goes up in “4 Legs” We have completed The 1st Leg with the pullback on to the $500.00 area about 6 weeks ago ( this chart is using Weekly bars )

This is important stuff. These days all I seem to write about is NVDA. And it is paying the bills right now no denying that. But SPY is a position that I entered for the long term about 5 months ago, have been adding incrementally along the way, and intend to add more with the continuation of this pattern.

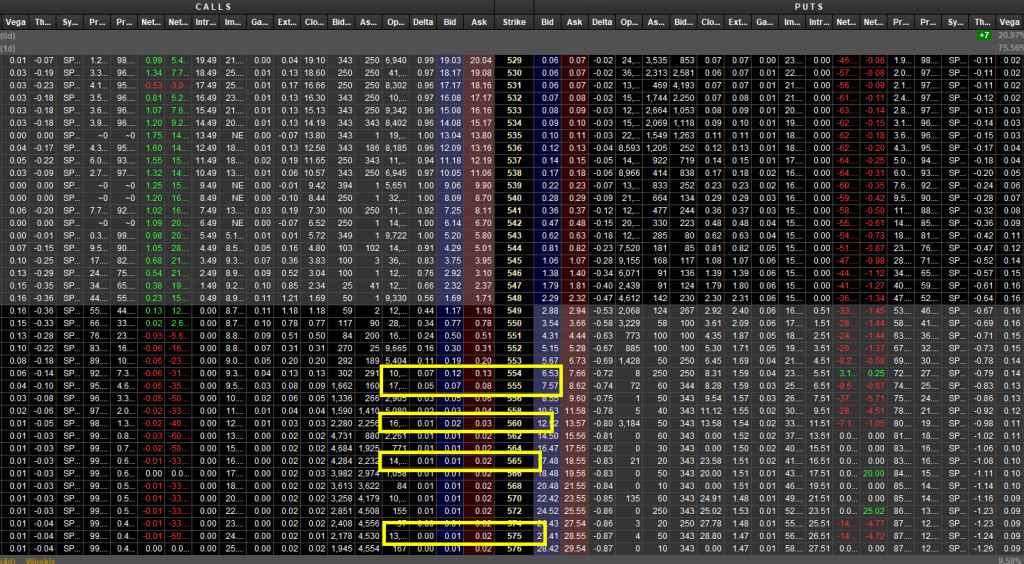

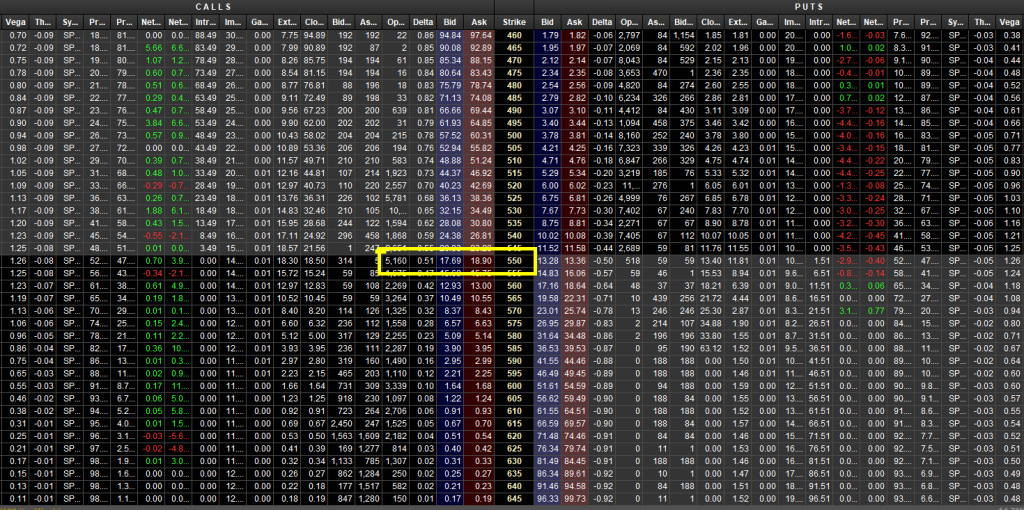

My target ( for now ) with Options goes all the way out until OCT 2024… ( that is not where I believe this will end, it’s simply where I have Options up to and am being paid premium along the way ) Remember I started buying 5 months ago. This isn’t my day trading acct, this is income producing for doing little to no work by simply following the markets movement. To offer you a visual representation of the buying action I captured 2 different Options chains for you. The 1st one is this Friday JUN 21, 2024….. The 2nd one is OCT 2024’s Monthly. The yellow highlighted areas speak for themselves with the highest Areas of Interest via O.I. ( Open Interest) You can multiply those numbers ( on the left side of the yellow highlighted ) by 100 and that then tells you how many shares if you will VS options contracts. That is NOT the Volume, they are not the same. Each Options contract represents 100 common shares. That is not to say that they will stop there, that’s just where the money is for those days. There will always be more buyers closer to the current date. So that means the JUN 21 will have more than the OCT. Then as time passes trades are bought or “rolled over” into the later dates. With the current trading of oDTE’s ( Zero Days to EXP ) the O.I. for this Friday will increase on Friday. Whether it’s buying or selling.

At the end of the day what all of this means is that buyers are currently stepping into this market. Currently astute investors are being rewarded handsomely with generous returns. And unless the market temperature changes, there’s no reason to step out.

Invest wisely, live charitably and be well

Brother Bill

DISCLAIMER: All content provided in this newsletter, blog, webinar, video, chart, communication is for Educational and Entertainment purposes only. Nothing included or mentioned is meant to be construed or used as trading / investment / financial advice. Trading / investing carries risk of loss, losses can and do occur. NO recording aloud…Know your risk and risk of loss before taking on any financial endeavors. Past performance is NOT a guarantee of future success. I am NOT a licensed or registered financial advisor or tax accountant. Prior to making any trading / investing / financial decisions you should always consult with your licensed and registered financial advisor and tax accountant. There are no recommendations or solicitations to buy, sell or hold any stock, future, options or bonds or any other financial entity in this newsletter. Nor are there any recommendations on any type or way or method to trade / invest. You do not have permission to redistribute this newsletter without my written permission first.

Discover more from Investing With Faith

Subscribe to get the latest posts sent to your email.